Exploring the world with a family on a budget is entirely possible when armed with effective strategies, allowing you to create beautiful memories without overspending- and sometimes even for free!

So how on earth do you travel on points? What does that even mean?

By utilizing credit card travel reward programs, the keys to budget-friendly travel lie in creative planning and research. Families can unlock a treasure trove of experiences at a fraction of the cost which paves the way for unforgettable adventures that won’t threaten the bank account.

Every family’s travel reward journey will look different, but I will break down the basics here for you.

When you sign up for a new credit card, it will come with a “welcome bonus offer,” which typically is anywhere from 30,000 to 100,000 points. These points are usually redeemable at least at a 1:1 rate, meaning 100,000 points equals $1,000 or more.

In order to earn this bonus, the bank requires you to reach what they call a minimum spend amount. For example, when you spend $4,000 in the first 3 months, you will reach your bonus.

The idea of traveling on points means you sign up for a card, reach the minimum spend, earn your bonus points, and repeat until you can cover your trip.

Maybe you’re thinking that this process sounds like too much work, but you know what is a lot of work? Saving your paychecks for years when instead, you could be literally watching your money work for you.

We use our current card for everything—gas, groceries, car loan, school tuition, etc. Let me tell you—it doesn’t usually take three months for us to hit the minimum spend.

The key is to use your card as if it’s a debit card. Do not put any extra expenses on it that you cannot afford. Always pay your card off every month to avoid interest charges. Skip the cash! You can instead earn 1-3% back on every dollar you spend.

There are lots and lots of myths out there about credit card points, but let me just touch on a few:

1. “This is horrible for your credit score.” False. As long as you are paying your card off each month, your credit score will not be affected. We have multiple cards and have been doing this for over 2 years and have only watched our scores increase (over 800 each). Your score will take a tiny dip when you apply for a new card, but that will recover quickly.

2. “Those cards have super high annual fees and are not worth it.” Yes, some do have higher annual fees, BUT they also come with travel credits and perks that offset the fees. As long as you pay attention to your benefits and actually use them, you will not lose out on money.

3. “It’s best to just have one card and keep building points on it.” False. Your welcome offers are what build your points the fastest. Sure, you can have one card and earn 1-2% back on your purchases for a few years to finally have enough to cover your trip. However, if you want to make a family vacation a yearly thing – you’re going to need more than one card. We simply stop using the card once we meet the bonus and move on to the next one. (I will touch on canceling cards a bit later)

The big question that often comes my way is, “which card should I sign up for?” This is where I always advise people to plan ahead. Different cards can be redeemed for different things. For example, the Capital One Venture X can be redeemed with Airbnb and other third-party bookings, whereas your Chase cards cannot. However, if you’re looking to save on airfare, Chase points are often worth more, and you will get more bang for your buck when you transfer them to an airline.

Plan.your.trip.first.

After you decide what your goal is, then you begin to look at what card works best to meet your goal as well as works with your current finances. Does one card have better benefits that you will use more than another? These are all things that you should be looking at.

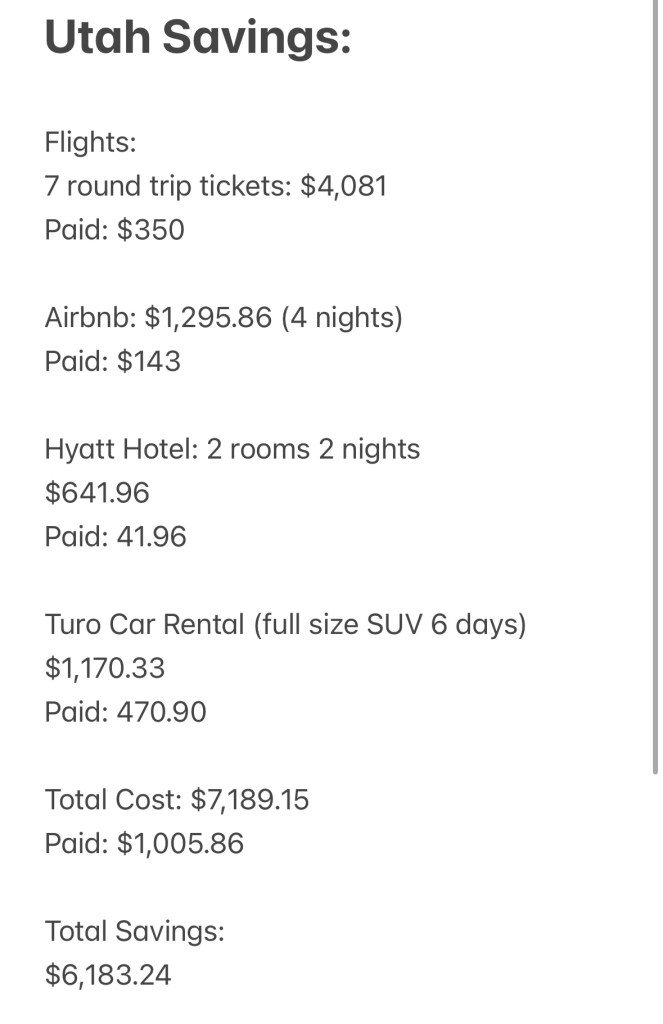

Whew. That was a lot of information! Still have questions? Email them my way, comment below, or follow along on Instagram for lots of tips and tricks we have found along the way! The proof is in the pudding – and the screenshot below shows how many points have saved us on our recent trip.

Ready to dive in? Check out our favorite products and links page in the menu to see a breakdown of a few of our favorite cards! You can click the links and apply directly through that page.

I can’t wait to hear all about how you earned free travel through your points!

Leave a reply to Weekend escapes: maximizing your vacation days throughout the year – Memories for Miles Cancel reply